Our developers worked with JobCost™ to determine what they need to use our export.

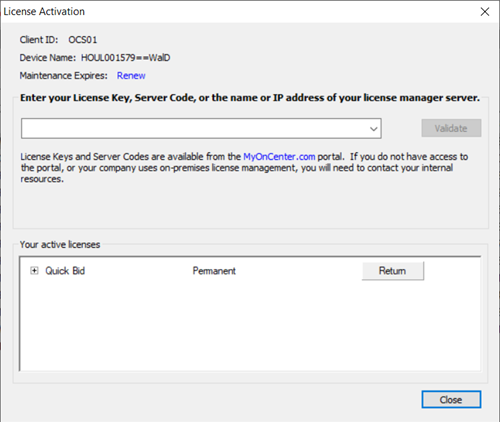

The Bid, Labor, and Material Exports are available to any licensed user, however the Accounting and Custom Exports are only available to users under a maintenance subscription.

If you've allowed your maintenance subscription to expire, you can renew easily by clicking File > Check Authorization and clicking the Renew link.

That link opens the MyAccount customer portal where you (or whoever can pay the invoice) may renew your maintenance subscription.

You can also contact Customer Success to discuss renewing your maintenance subscription.

Tech Support does not provide assistance with importing the Budget File into your Accounting package. Accounting packages are very complex and the vendor of your particular Accounting package is best equipped to support it.

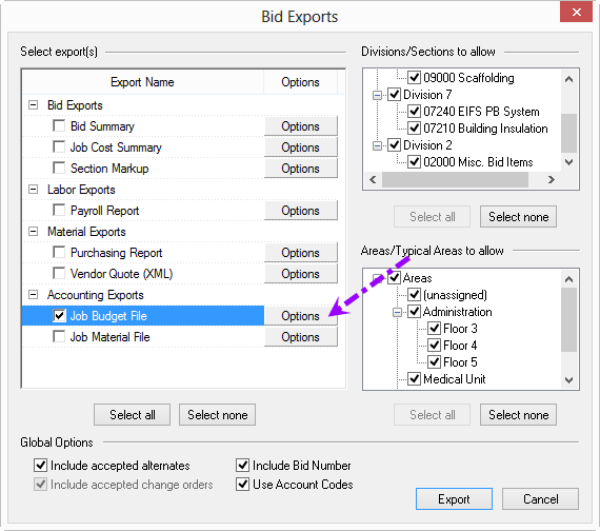

Generate the Export File

To export the budget to JobCost Accounting software,

- Click the Exports button on the Bid toolbar

- Select Job Budget File

- Click the Options Button next to "Job Budget File" - the Modify Options for Job Budget File dialog box opens

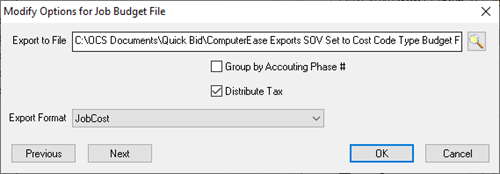

Material Tax

This Accounting Export includes an option called "Distribute Tax":

- When checked, Material Tax is rolled into the Material Cost Code from which it is derived

- When unchecked, Material Tax shows as a separate line item, associated with the same Material Cost Code, but with a different Category Code ("MT" instead of "M").

From the Export Format drop down,

- Select "JobCost" (exports to a CSV file)

- Select the options and filename/location where the export file is to be saved

- Click the OK button to return to the Bid Exports screen

- Click the Export button (your file is not generated until you click the Export button)

The Budget File export allows you to create a Budget in JobCost Accounting Software, based on the final Bid information from Quick Bid. For assistance importing a budget file into JobCost Accounting Software, please consult your JobCost Accounting Software User Guide or JobCost 's support.

Category Codes (Cost Types) are Not Exported

This export does not support exporting the Category Code (M, L, S, E, O, etc.) to define the type of Cost (Material, Labor, Subs, Equip, and Other Costs), although the various types of Cost are separated into different columns.

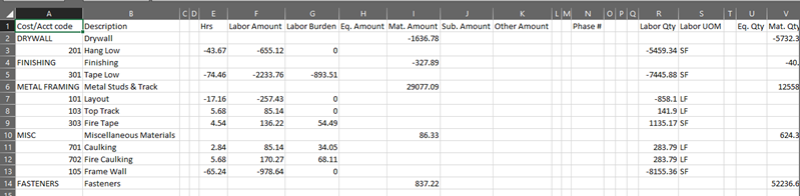

Export Column Definition

When grouped by Accounting Phase #, Amounts, Hours, and Quantities roll up all Bid Areas with same Phase #. All bid areas with empty Phase # roll up together.

Column headers are included in this export.

| Column | JobCost Field | On Center Field | Description/Business Rule | JobCost Data Requirement | On Center Data Requirement |

|---|---|---|---|---|---|

| A | Phase | Cost Code | If Use Account Codes is not checked: “<Cost Code>” If Use Account Codes is checked: “<Account Code>”, If Cost Code does not have an assigned Account Code, then “<Cost Code>” | 10 Alpha | 50 Alpha |

| B | Phase Name | Description | If Use Account Codes is not checked: “<Cost Code Description>” If Use Account Codes is checked: “<Account Code Description >”, If Cost Code does not have an assigned Account Code, then “<Cost Code Description >” | 40 Alpha | 75 Alpha |

| C | Phase Billing QTY | Blank | Blank | (999999999999.99) Numeric | |

| D | Billing | Blank | Blank | 6 alpha | |

| E | Cost Type 1 Units | Labor Hours | <Labor Hours> | (999999999999.99) Numeric | Numeric |

| F | Cost Type 1 | Labor | <Labor Net Amount> | (999999999999.99) Numeric | Numeric |

| G | Cost Type 2 | Burden | <Burden> | (999999999999.99) Numeric | Numeric |

| H | Cost Type 3 | Equipment | If Distribute Tax is unchecked, <Equipment Net Amount> If Distribute Tax is checked, <EquipmentNet Amount+Tax> | (999999999999.99) Numeric | Numeric |

| I | Cost Type 4 | Material | If Distribute Tax is unchecked, <Material Net Amount> If Distribute Tax is checked, <Material Net Amount+Tax> | (999999999999.99) Numeric | Numeric |

| J | Cost Type 5 | Sub | If Distribute Tax is unchecked, <Subcontractor Net Amount> If Distribute Tax is checked, <Subcontractor Net Amount+Tax> | (999999999999.99) Numeric | Numeric |

| K | Cost Type 6 | Miscellaneous | If Distribute Tax is unchecked, <Other Net Amount> If Distribute Tax is checked, <Other Net Amount+Tax> | (999999999999.99) Numeric | Numeric |

| L | Billing Contract | Blank | Blank | (999999999999.99) Numeric | Numeric |

| M | Workers' Comp | Blank | Blank | 10 Alpha | |

| N | Phase Type | Accounting Phase # | If Group by Accounting Phase # is unchecked, Blank If Group by Accounting Phase # is checked, <Accounting Phase #> Blank if Accounting Phase # value is blank | 10 Alpha | 50 Alpha |

| O | Change Order ID | Blank | Blank | ||

| P | Change Order Status | Blank | Blank | Pending, Approved or Rejected | |

| Q | Sort Group | Blank | Blank | 10 Alpha | |

| R | Production Cost Type #7 | Blank | Blank | (999999999999.99) Numeric | |

| S | Production Cost Type | Blank | Blank | 6 Alpha | |

| T | Labor OH | Blank | Blank | (999999999999.99) Numeric | |

| U | Equipment | Quantity | Equipment <Quantity> | (999999999999.99) Numeric | Numeric |

| V | Material | Quantity | Material <Quantity> | (999999999999.99) Numeric | Numeric |

| W | Subcontractor | Quantity | Sub <Quantity> | (999999999999.99) Numeric | Numeric |

| X | Miscellaneous | Quantity | Other <Quantity> | (999999999999.99) Numeric | Numeric |

| Y | Labor | Blank | 6 Alpha | ||

| Z | Labor OH | Blank | Blank | Blank | |

| AA | Equipment | Blank | Blank | 6 Alpha | |

| AB | Material | Blank | Blank | 6 Alpha | |

| AC | Subcontractor | Blank | Blank | 6 Alpha | |

| AD | Miscellaneous | Blank | Blank | 6 Alpha | |

| AE | Vendor ID | Blank | Blank | Blank | |

| AF | Labor OH | Blank | Blank | 6 Alpha |

Related Articles